SSF-Logistics

New Member

Introduce

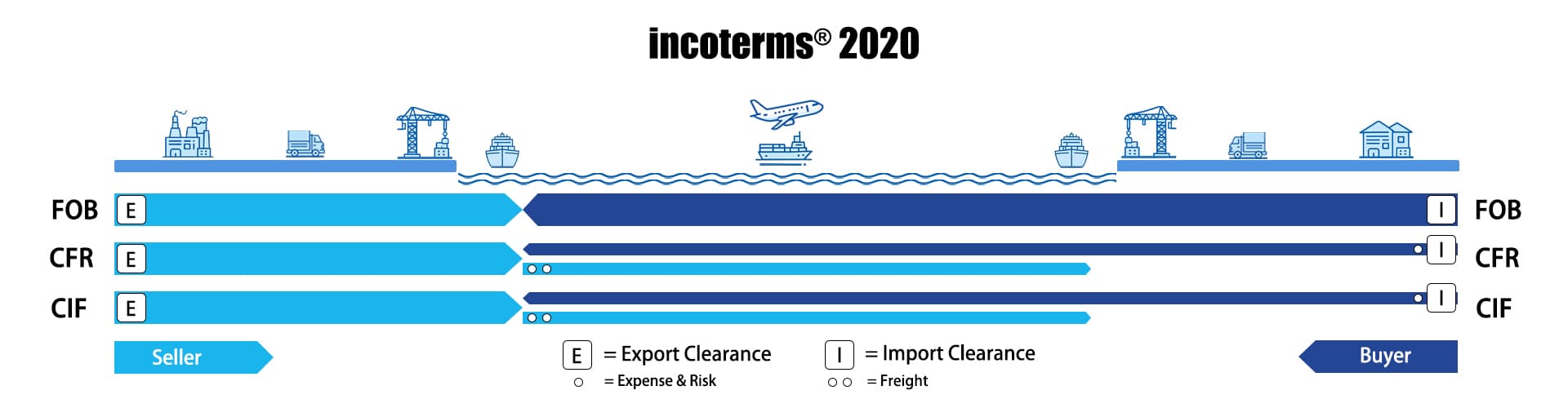

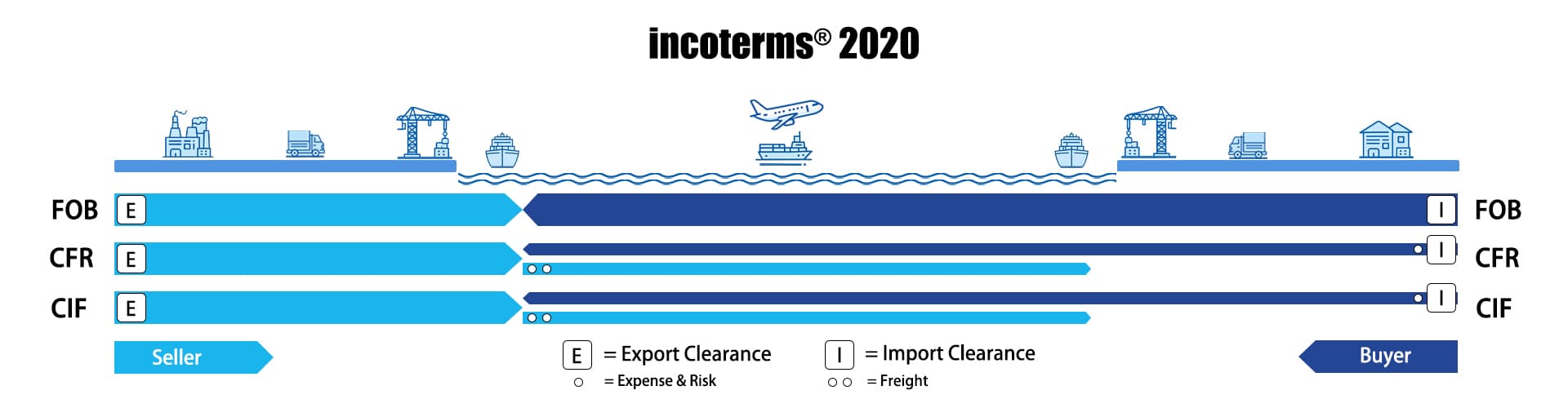

In international trade, buyers and sellers must clarify responsibilities, cost allocations, and risk transfer points for goods delivery. FOB, CIF, and CFR (formerly CNF) are three widely used trade terms defined by the International Chamber of Commerce (ICC) under Incoterms. This article explains their definitions, key differences, and practical applications to help businesses mitigate risks and optimize cross-border transactions.

Yes. CNF is an outdated term; Incoterms now uses CFR exclusively.

Q2: Who bears the risk if goods are damaged under CIF?

The buyer assumes risk after loading. Even though the seller buys insurance, the buyer must file claims with supporting documents.

Q3: Can FOB be used for air freight?

No. FOB applies only to sea transport. For air shipments, use FCA (Free Carrier).

By understanding these trade terms, companies can negotiate contracts confidently, streamline operations, and safeguard profitability in global trade.

In international trade, buyers and sellers must clarify responsibilities, cost allocations, and risk transfer points for goods delivery. FOB, CIF, and CFR (formerly CNF) are three widely used trade terms defined by the International Chamber of Commerce (ICC) under Incoterms. This article explains their definitions, key differences, and practical applications to help businesses mitigate risks and optimize cross-border transactions.

1. Definitions of FOB, CIF, and CFR

- FOB (Free On Board; Port of Shipment)

- Responsibility: The seller delivers goods onto the buyer nominated vessel at the agreed port, handles export clearance, and transfers risk once goods are loaded.

- Risk Transfer: Risk shifts from seller to buyer when goods are placed on board (per Incoterms 2020).

- Costs: Seller covers pre-shipment costs (inland transport, loading); buyer handles ocean freight, insurance, and destination charges.

- CIF (Cost, Insurance, and Freight; Port of Destination)

- Responsibility: The seller pays for freight and basic insurance, delivers goods to the destination port, and manages export formalities.

- Risk Transfer: Risk transfers at the origin port (same as FOB), even though the seller arranges transport.

- Costs: Seller covers freight and minimum insurance (e.g., 110% cargo value under Institute Cargo Clauses C); buyer handles destination fees and additional risks.

- CFR (Cost and Freight; Port of Destination)

- Note: CFR replaced the outdated term;CNF; to align with Incoterms; standards.

- Responsibility: Seller pays freight to the destination port but does not procure insurance; the buyer must insure the goods.

- Risk Transfer: Risk transfers at origin port (same as FOB and CIF).

2. Key Differences Between FOB, CIF, and CFR

Compare these terms using the table below:| Aspect | FOB | CIF | CFR |

|---|---|---|---|

| Freight Payer | Buyer | Seller | Seller |

| Insurance | Buyer's liability | Seller (basic cover) | Buyer's liability |

| Risk Transfer | At origin port | At origin port | At origin port |

| Transport Mode | Sea or inland waterway | Sea or inland waterway | Sea or inland waterway |

| Seller Obligations | Export clearance, loading | Freight, insurance, export clearance | Freight, export clearance |

3. How to Choose the Right Trade Term?

- When to Use FOB

- Buyer prefers control over shipping (e.g., negotiated carrier rates).

- Buyer seeks customized insurance (e.g., high-value goods requiring additional coverage).

- When to Use CIF

- Seller aims to offer competitive pricing (bundled freight and insurance).

- Buyer lacks expertise in destination port logistics.

- When to Use CFR

- Seller provides cost-effective freight but avoids insurance costs.

- Buyer can arrange insurance independently to reduce expenses.

- Under CIF, sellers only procure minimum insurance; buyers may need supplemental coverage.

- In FOB, delays in vessel nomination by the buyer can lead to demurrage disputes.

4. Frequently Asked Questions (FAQ)

Q1: Are CFR and CNF the same?Yes. CNF is an outdated term; Incoterms now uses CFR exclusively.

Q2: Who bears the risk if goods are damaged under CIF?

The buyer assumes risk after loading. Even though the seller buys insurance, the buyer must file claims with supporting documents.

Q3: Can FOB be used for air freight?

No. FOB applies only to sea transport. For air shipments, use FCA (Free Carrier).

5. Conclusion

The core distinctions among FOB, CIF, and CFR lie in freight and insurance responsibilities, while risk transfer occurs at the origin port in all cases. Businesses should select terms based on financial capacity, logistics control, and risk appetite, ensuring contracts specify the Incoterms version (e.g., 2020) to avoid disputes.By understanding these trade terms, companies can negotiate contracts confidently, streamline operations, and safeguard profitability in global trade.